Financial Wellness

Hold On To Your Money by Keeping Your Accounts Active

Ever wonder what happens to the money in a financial account that is forgotten about? Dormant member accounts—accounts that sit unused (usually due to the owner's death, inattentiveness, or forgetfulness) may commonly be thought of as a rare occurrence, but it happens to many members. It's estimated that there's $80 billion in unclaimed money waiting to find a home.

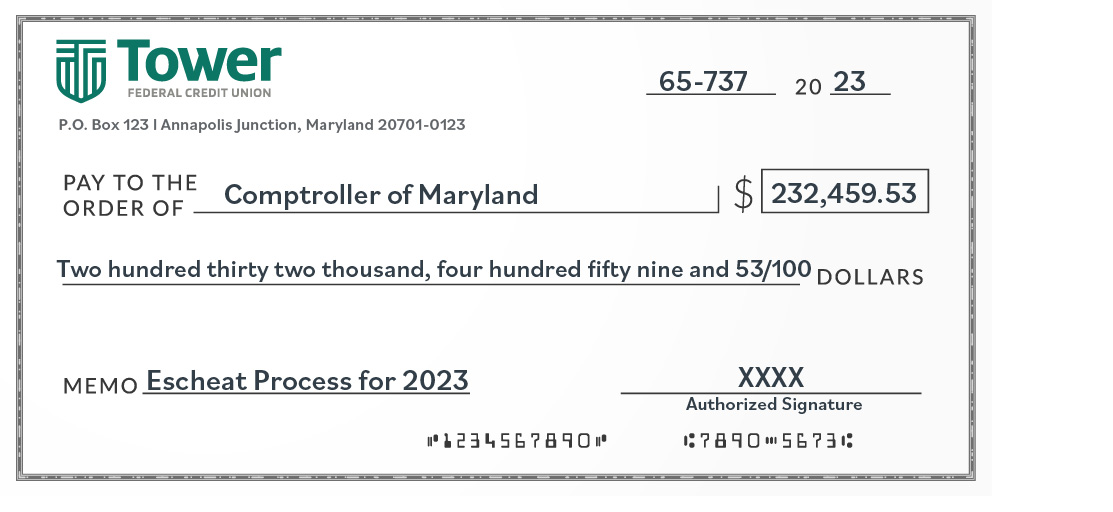

It's important to know that once an account becomes dormant, the funds escheat, or revert, to the state. If you or a family member have not used your Tower account in the last three years, the account will be considered abandoned by Maryland state law. This law requires that the funds in these accounts be sent to the state.

But you can prevent this.

An easy way to keep your Tower account(s) from becoming dormant is to make a small deposit to your account(s), at least once a year. You can keep your accounts active by regularly logging into Digital Banking to view all of your accounts. Doing this will keep each account active and remove the risk of the account being escheated to the state.

Annual deposits or regularly logging into Digital Banking will also prevent the account from going inactive and being charged an Inactive Account Fee.

When an account becomes inactive, it is often because the owner has either forgotten or moved away from the area without updating his or her mailing address. If you plan to move, don't forget to complete a change of address form for safe delivery of important communications from Tower.

There are a few ways to update your address:

- Login to online banking at towerfcu.org and select Help & Support, then Settings, Contact.

- Login in our mobile app and tap More, then Settings, Contact.

- Visit towerfcu.org, go to Forms then Change of Address.

Avoid escheatment.

Members without a monetary transaction within their Tower account(s) or who have not logged into Digital Banking in the last three years will receive a letter this month with instructions on how to avoid having the funds sent to the state of Maryland.

For answers to questions about your Tower accounts, call the Member Service Center at 866-56-TOWER.

*Mobile Banking services are free to all Tower members. Your carrier's message and data rates may apply. Other Mobile Deposit restrictions may apply.